Time to Take Cover? S&P 500 and Dollar Drop in Tandem

created At: 4/15/2025

Sell

This analysis includes a sell recommendation. Please carefully review all mentioned risk before proceeding.

50

4

0

Fact

Over the past 3 months, the S&P 500 has declined 7.96%, while the US Dollar Index (DXY) fell 8.99%.

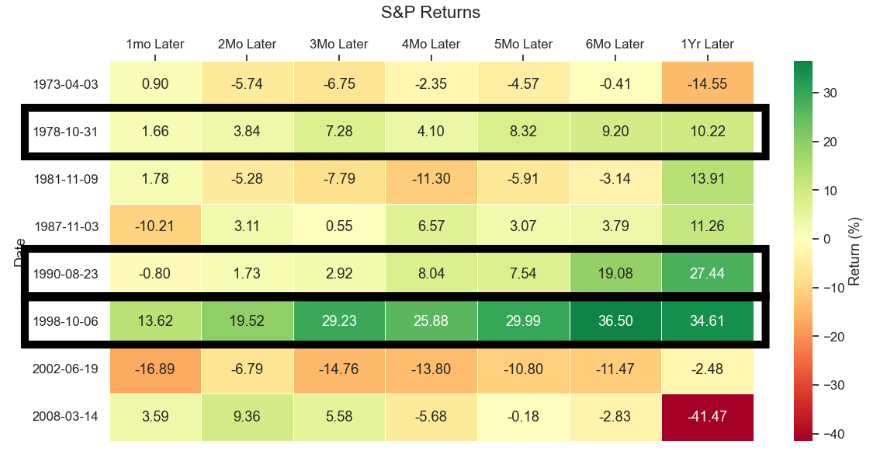

Dual 7%+ drops in both markets have occurred only 8 times since 1973.

In 6 out of 8 instances, deeper lows followed; only 2 cases (1978, 1998) marked the bottom.

The dollar rebounded within one year 75% of the time, but showed no consistent 6-month pattern.

Opinion

There are growing signs that global investors are rotating away from US assets in response to tariff-related uncertainty under the Trump administration.

Some market participants fear that the dollar’s reserve currency status could face challenges in the long run.

Rather than a collapse of the dollar, current flows may reflect a temporary capital retreat to home markets driven by policy volatility.

Core Sell Point

This is a rare occurrence where both equities and the dollar are falling together. Historically, such moves have often preceded deeper market troughs—caution and risk management are warranted.

50

4

0

Comments

0

Please leave a comment first