Apple’s May 1 Earnings: What Is an “Event-Driven” Strategy?

created At: 4/24/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

24

3

0

Fact

-Apple is scheduled to release its Q1 2025 earnings (fiscal Q2) on May 1, 2025.

-The consensus estimates are EPS of $1.61 and revenue of $94.22 billion.

-As of April 24, Apple shares are trading at $204.60.

-Morgan Stanley maintains an “Overweight” rating with a price target of $220.

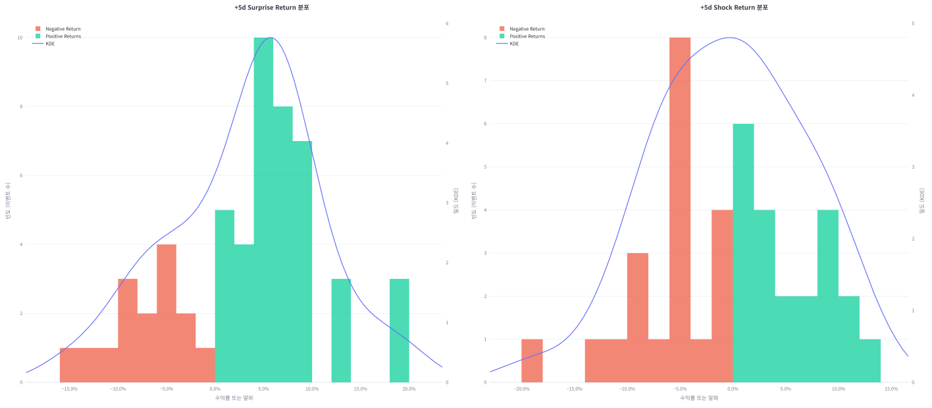

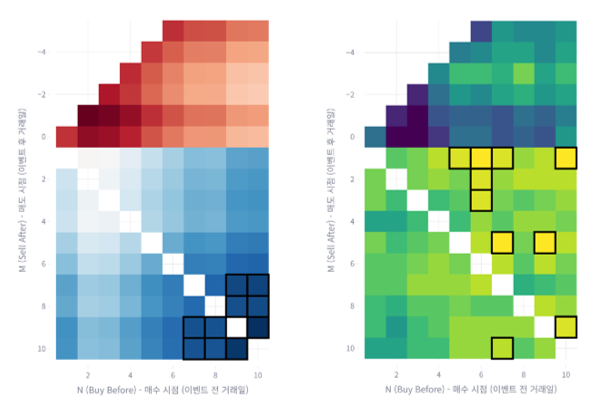

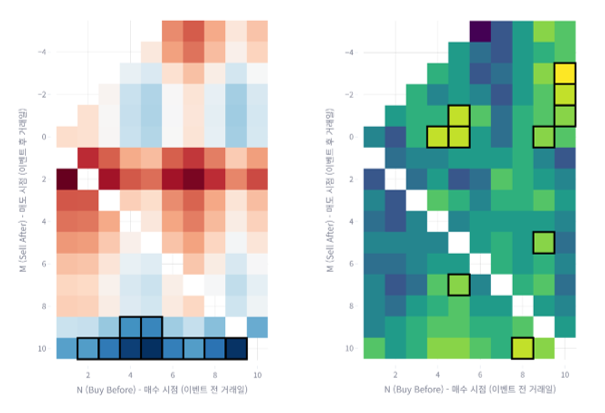

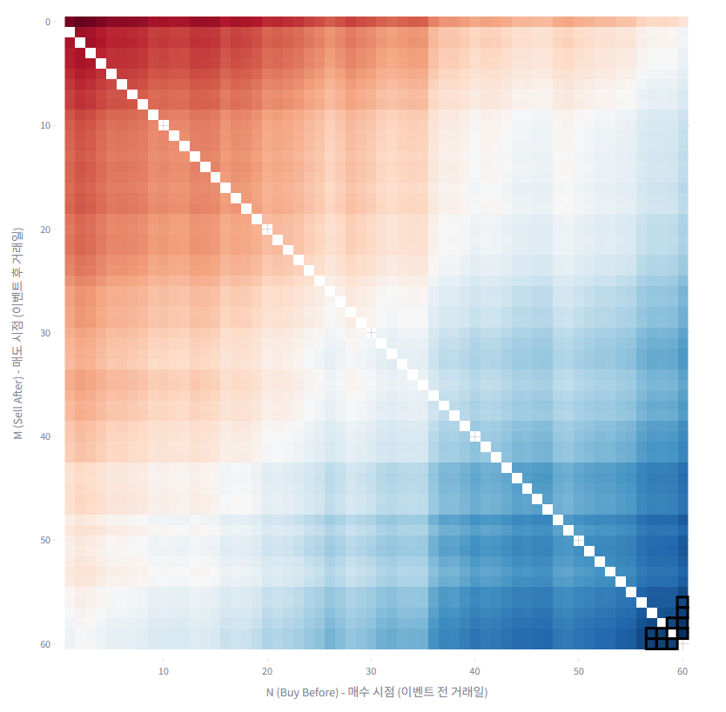

-An event-driven strategy seeks short-term gains by trading the volatility around company-specific events such as earnings announcements.

Opinion

-Among short-term trading approaches, event-driven earnings strategies stand out for their clarity in timing and data-based predictability.

-When companies like Apple post earnings surprises, both returns and win rates consistently improve. For informed investors, this can present a compelling opportunity.

Core Sell Point

While event-driven strategies may seem attractive, they require speed, precision, and analysis. For individual investors, selecting fundamentally strong stocks for long-term holding often yields better consistency in returns and win rates.

24

3

0

Comments

0

Please leave a comment first