Tariff Troubles: Why Tesla and NVIDIA Struggle Under Trump's Trade Policy

created At: 3/31/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

83

0

0

Fact

Trump’s tariff announcements consistently weigh on U.S. big tech stocks.

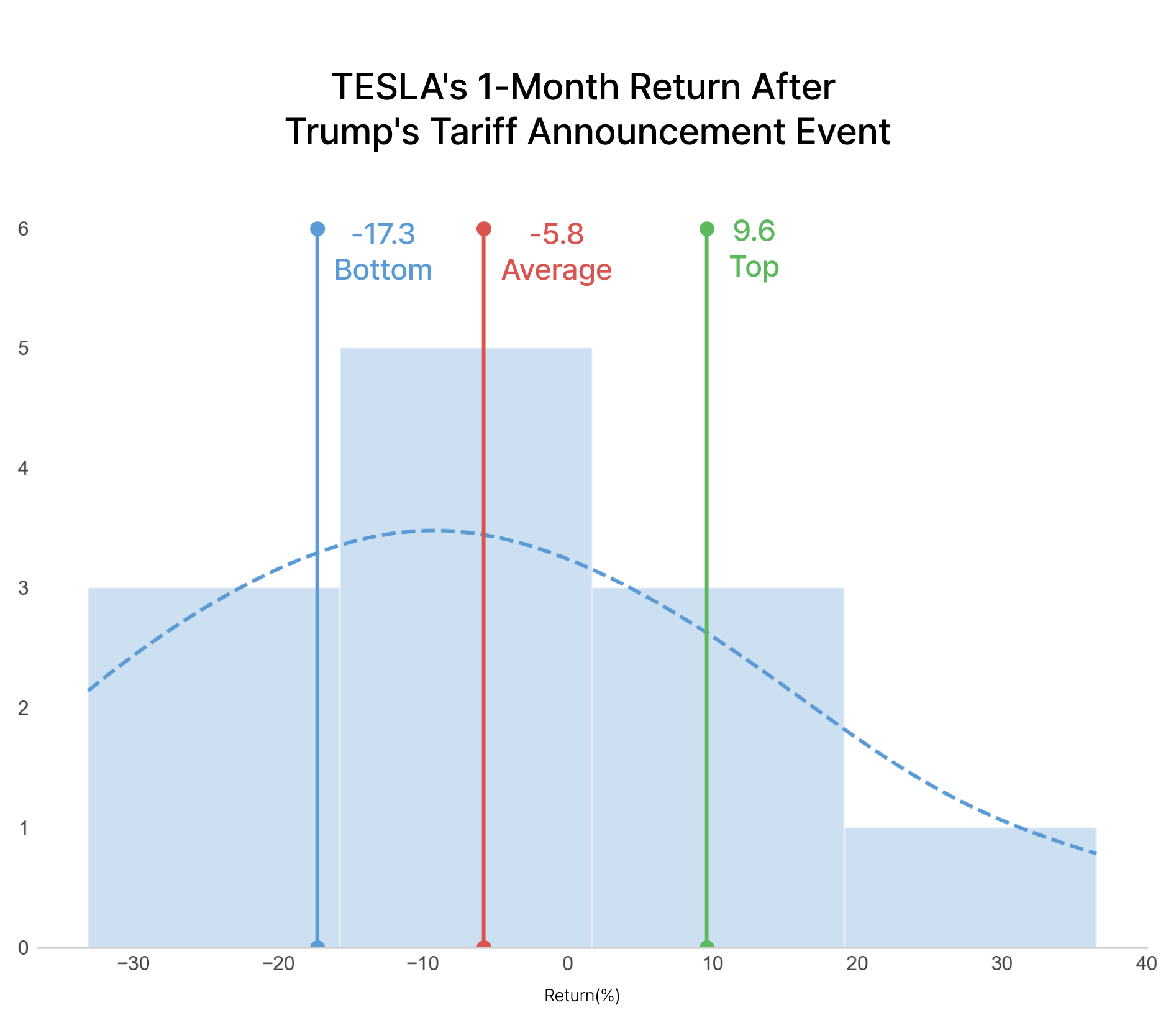

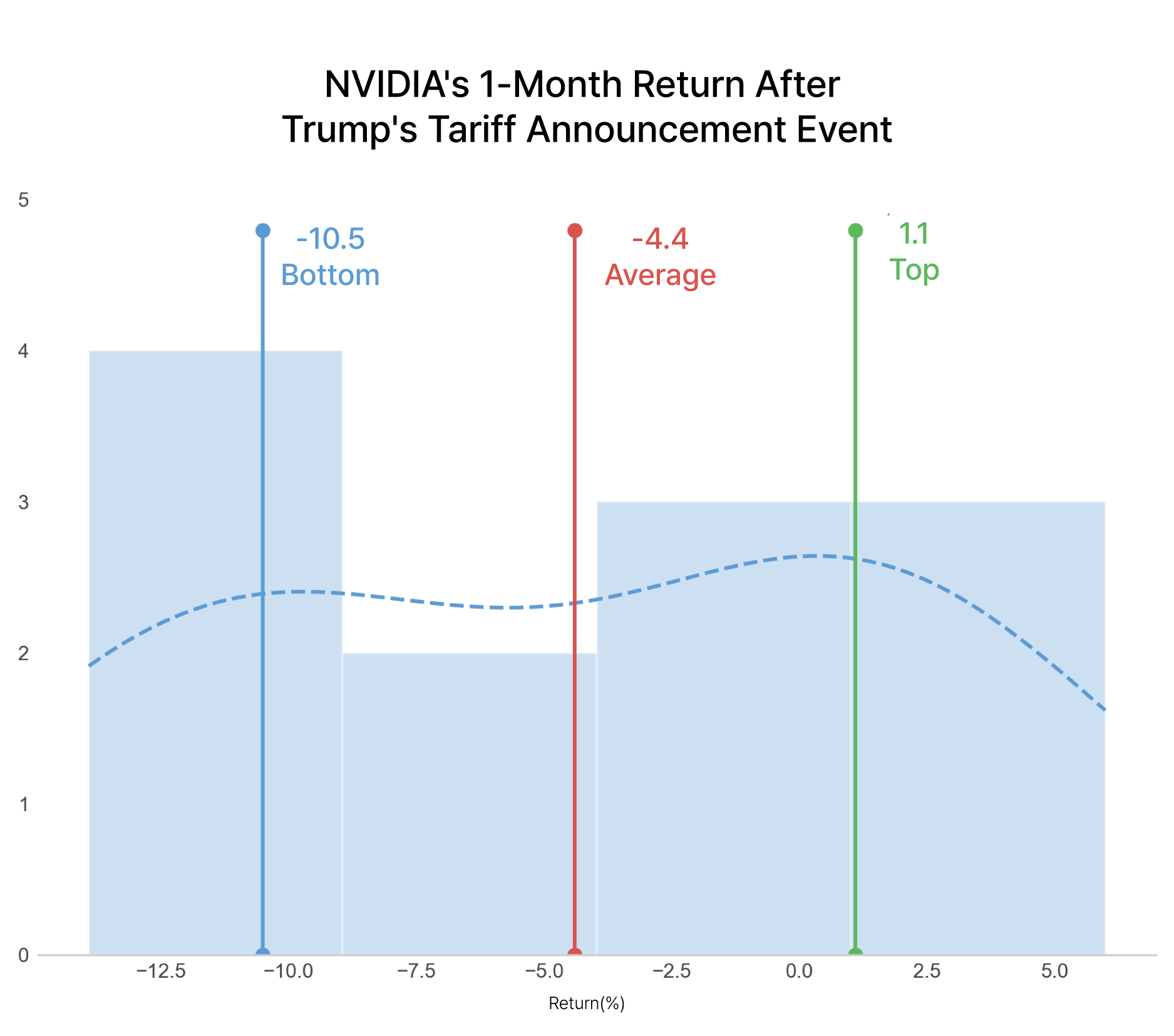

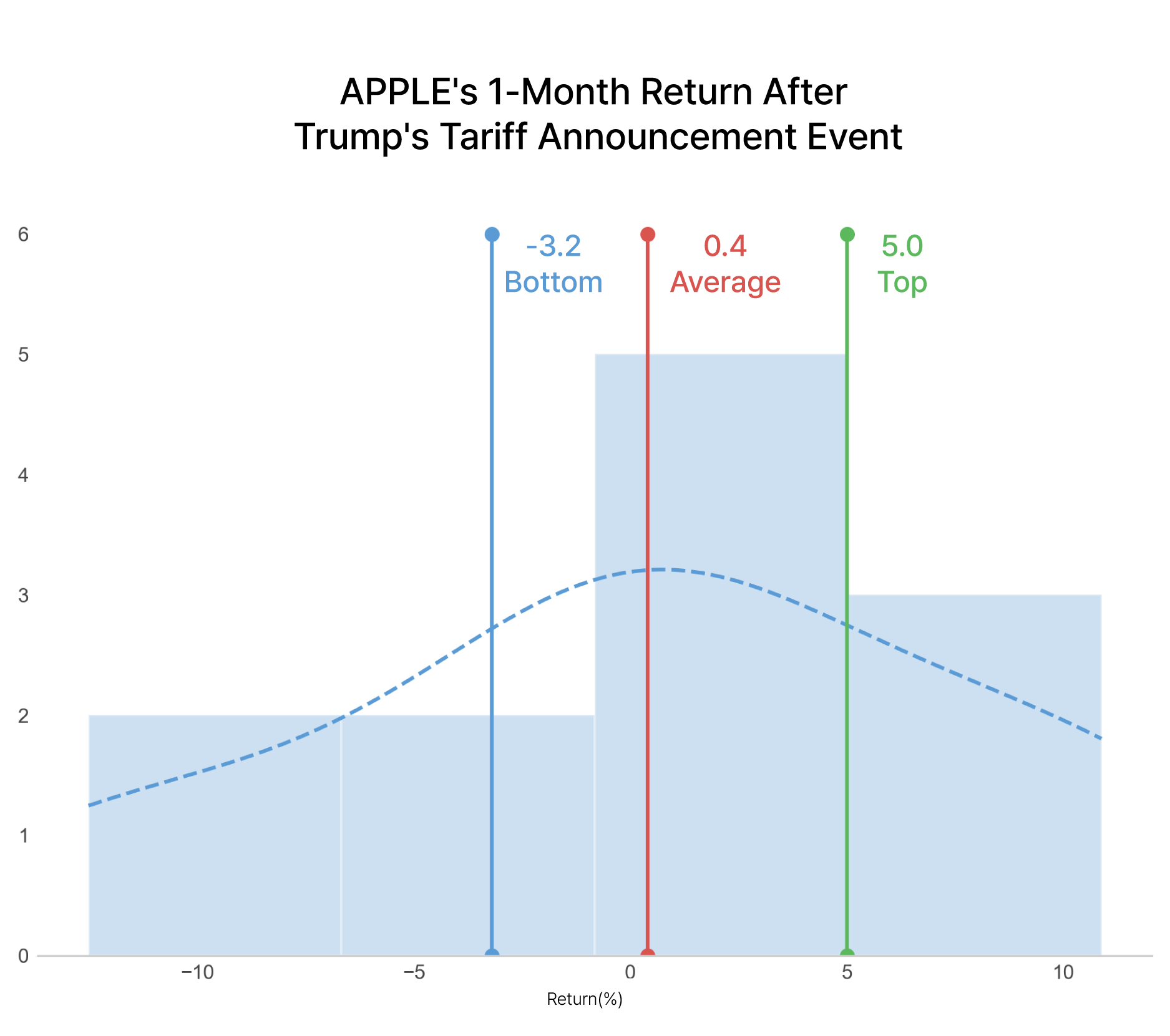

1-month average stock returns following tariff events:

-Tesla: -5.8%

-NVIDIA: -4.4%

-Apple: +0.4%

Opinion

The tariff impact has been more severe on Tesla and NVIDIA compared to Apple, despite Apple’s still significant China exposure. This indicates that tariff sensitivity is not solely driven by export percentages but also by market sentiment and sector-specific risks.

Core Sell Point

When it comes to Trump-era tariff headlines, Tesla and NVIDIA tend to suffer the most, making them especially vulnerable to further escalation of trade tensions.

83

0

0

Comments

0

Please leave a comment first