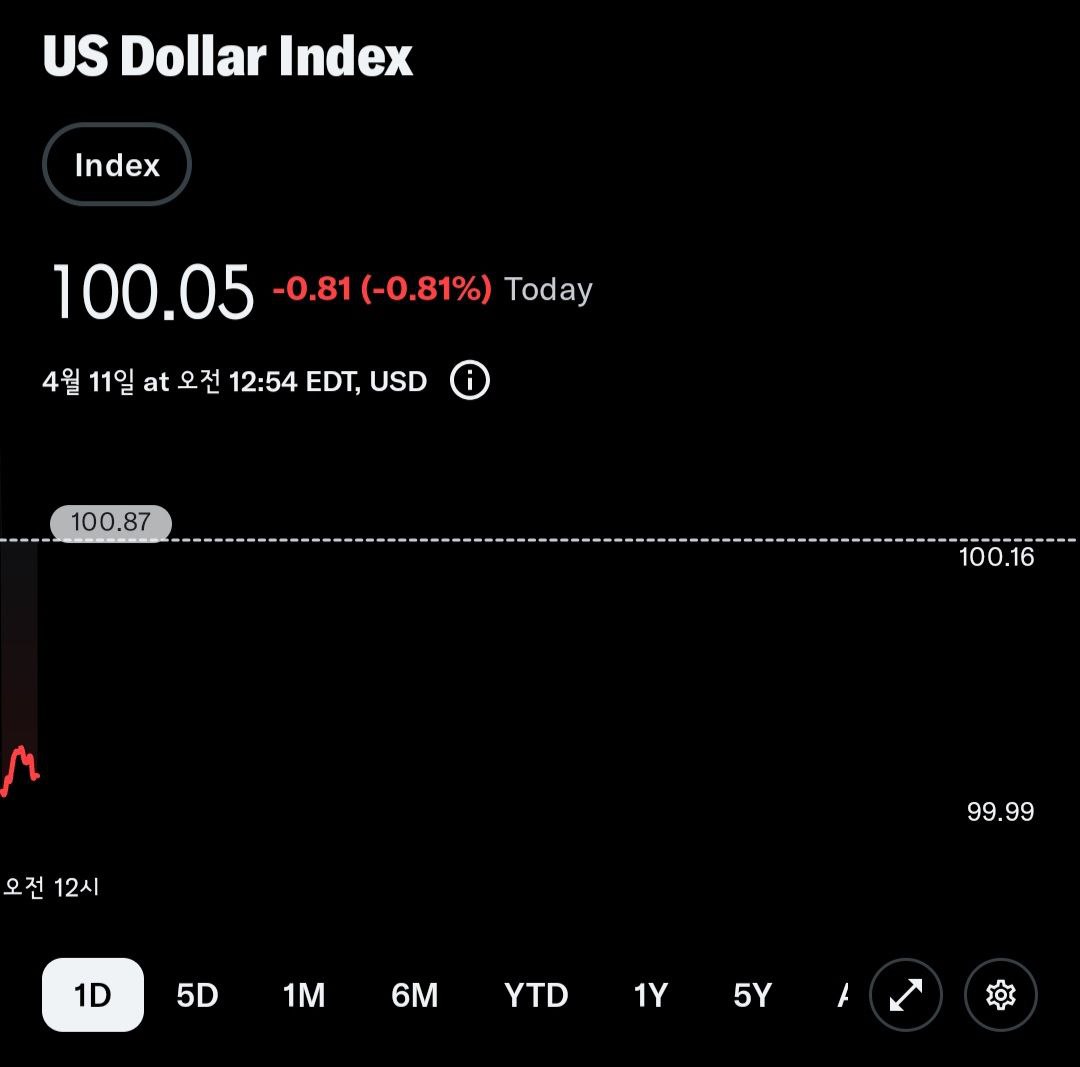

Dollar Index Breaks Below 100 — Is a Confidence Crisis Brewing? (Apr 11, 2025)

created At: 4/12/2025

Sell

This analysis includes a sell recommendation. Please carefully review all mentioned risk before proceeding.

8

0

0

Fact

Dollar Index fell to 100.05, down –0.81%

First dip below 100 since April 2022

Driven by weakening trust in U.S. policy amid rising tariffs and trade tensions

Contrasts with historical dollar strength during global uncertainty

Opinion

The DXY’s breakdown underscores rising uncertainty in U.S. external policy and its weakening influence on global capital confidence. The dollar’s diminished status as a “risk-off” currency may signal broader instability across U.S. financial markets.

Core Sell Point

Sustained dollar weakness may reflect deepening skepticism toward U.S. assets, potentially accelerating foreign capital outflows. The currency's trajectory will be critical for gauging cross-asset market risk.

8

0

0

Comments

0

Please leave a comment first