The Cloud Wars: OpenAI May Be the Key Battlefield

created At: 5/6/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

29

0

0

Fact

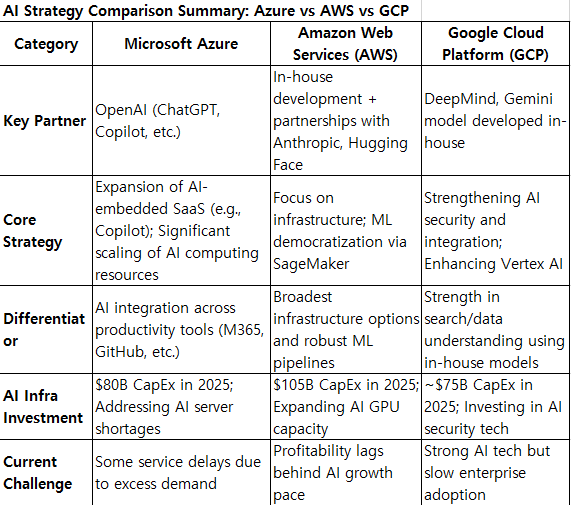

-In Q1 2025, Microsoft Azure posted 33% YoY revenue growth, outpacing AWS (17%) and Google Cloud (28%)

-AWS, Microsoft, and Google Cloud collectively account for 63% of the global cloud market

-Microsoft provides core infrastructure services like Cosmos DB to OpenAI through a dedicated Azure usage agreement

Opinion

-Azure’s outperformance is likely driven by its strategic partnership with OpenAI

-This is no longer just a competition of cloud technologies, but a race to secure AI-native workloads at scale

Core Sell Point

Microsoft Azure led the Q1 2025 cloud market in growth rate, signaling a shift in momentum as its partnership with OpenAI fuels a surge in infrastructure demand.

29

0

0

Comments

0

Please leave a comment first