Is the “Sell in May” Strategy Still Relevant? The Truth Behind the Summer Market Myth

created At: 5/4/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

26

0

0

Fact

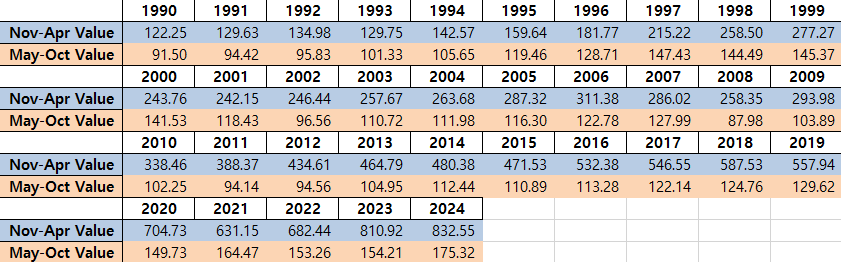

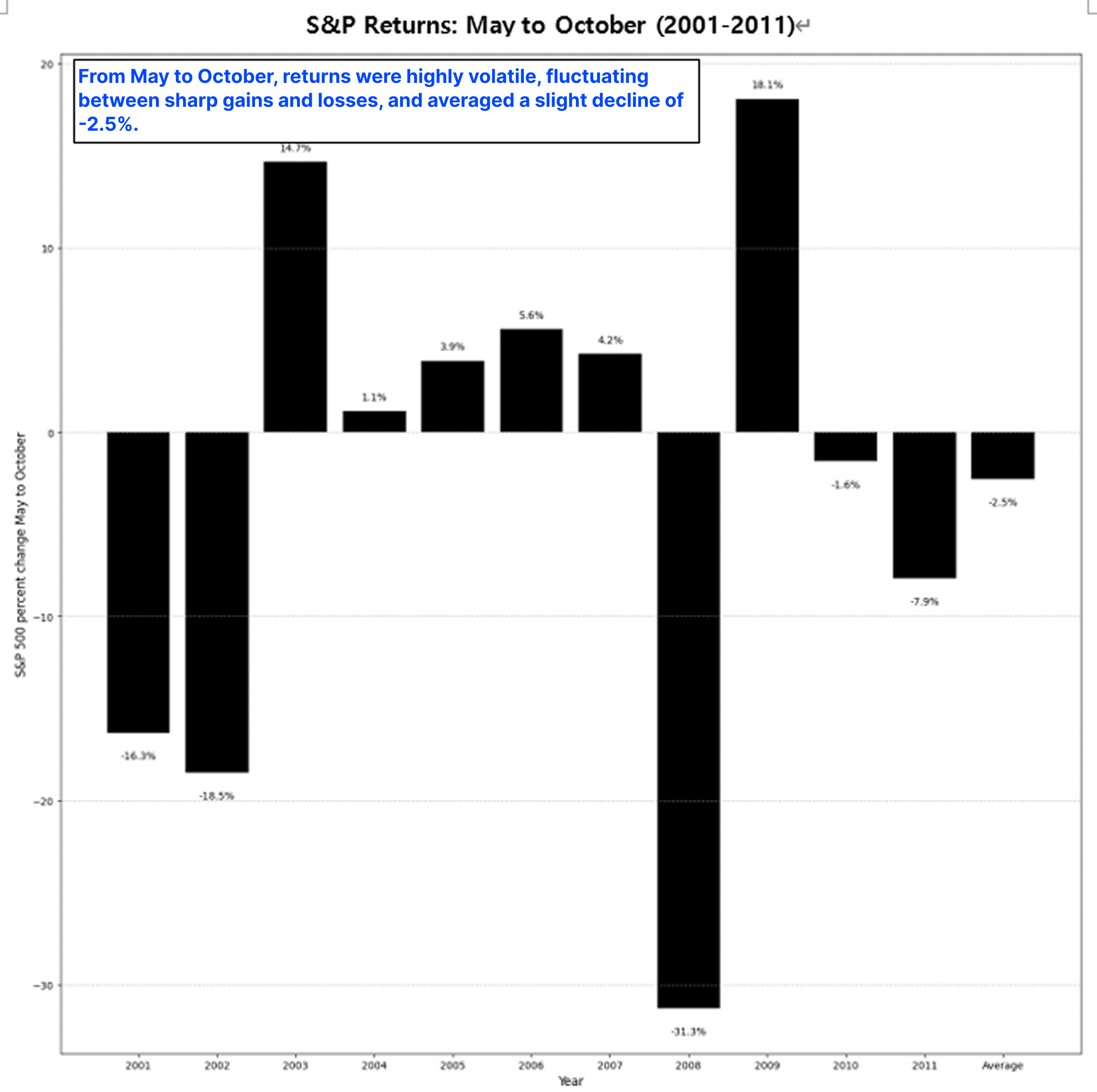

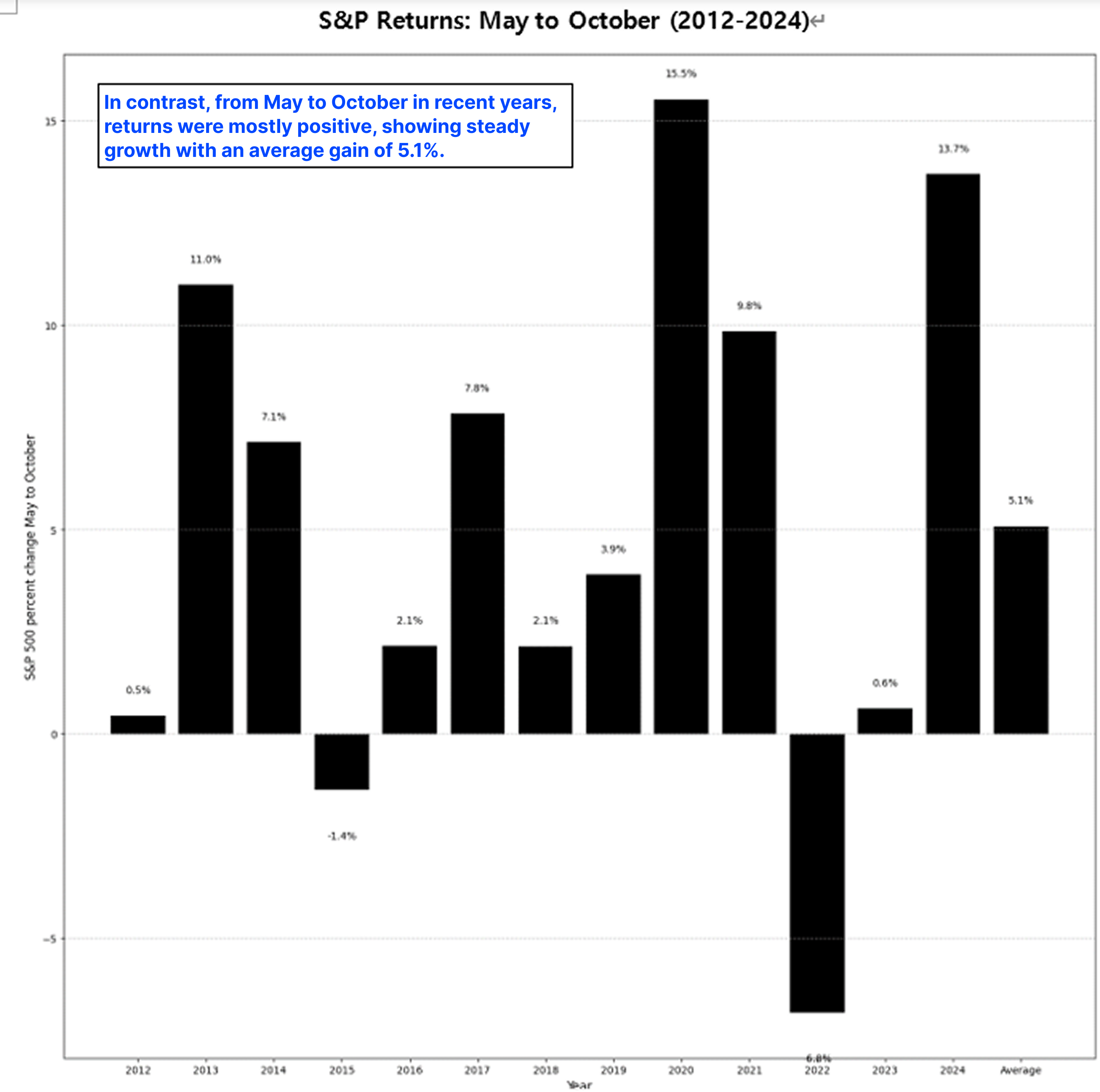

-“Sell in May and Buy in October” is a long-standing investment adage suggesting investors should exit stocks in May and re-enter in October.

-Historically, returns from May to October were weaker than those from November to April.

-However, in the past decade, summer months have often delivered strong returns—diminishing the seasonal effect.

Opinion

While “Sell in May” worked in certain historical periods, today’s markets have changed structurally. Relying solely on seasonal patterns is no longer sufficient; a holistic approach considering macro conditions, investor behavior, and corporate fundamentals is now essential.

Core Sell Point

The “Sell in May” rule is no longer a reliable one-size-fits-all strategy.

26

0

0

Comments

0

Please leave a comment first