Microsoft’s Q1 Earnings Are Approaching — What’s at Stake?

Microsoft (MSFT) is scheduled to report its first-quarter results on April 30, 2025.

As earnings season approaches, investor attention naturally shifts toward the numbers — and for a market heavyweight like Microsoft, earnings results can have an outsized impact on short-term stock moves.

This report analyzes how past earnings surprises — the degree to which actual results exceeded or missed Wall Street expectations — have influenced Microsoft’s stock returns, both immediately and over time.

What Is the Earnings Surprise Ratio?

The earnings surprise ratio measures the percentage difference between actual earnings and consensus estimates.

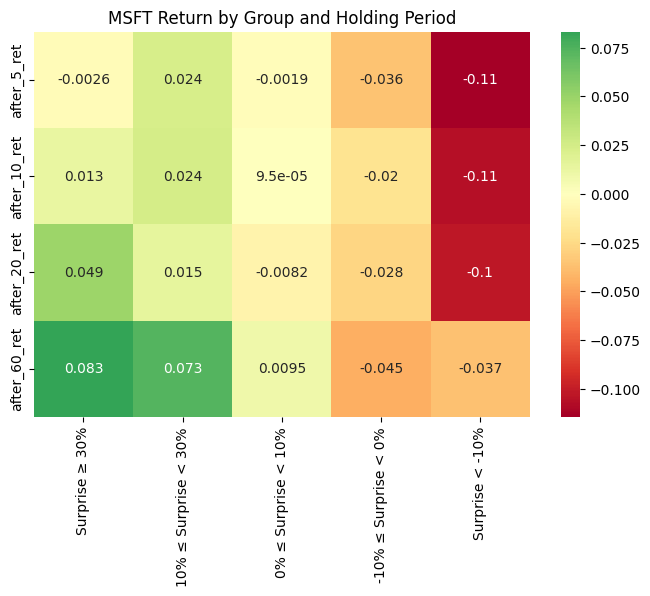

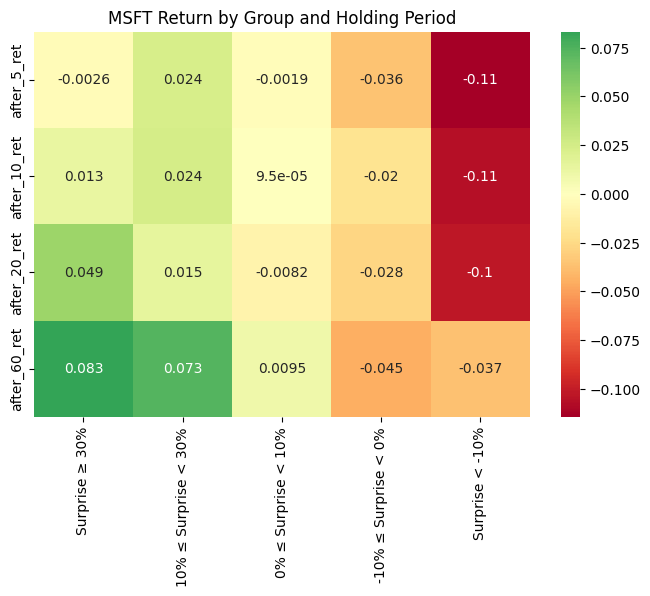

The heatmap below visualizes how Microsoft's average returns have behaved after earnings, categorized by surprise size and holding period:

Each group’s average returns were tracked over 5, 10, 20, and 60 trading days after earnings releases.

The findings are clear:

When Microsoft delivered an earnings surprise greater than 10% — particularly above 30% — the stock consistently generated positive returns over all periods.

Notably, the average returns over 20 and 60 days hovered around 7–8%, demonstrating that a strong earnings beat can fuel not just short-term pops but also mid-term momentum.

In contrast, smaller beats (0–10%) or slight misses (-10–0%) yielded flat or negative returns.

A significant earnings miss (-10% or more) resulted in negative average returns across all holding periods, with notable drawdowns at the 20- and 60-day marks.

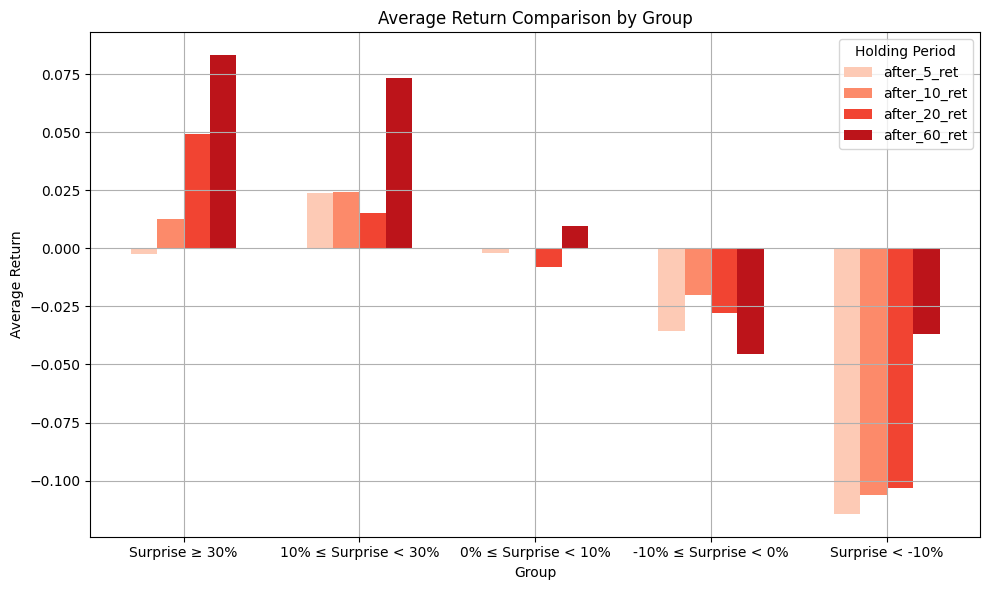

Average Return by Surprise Group

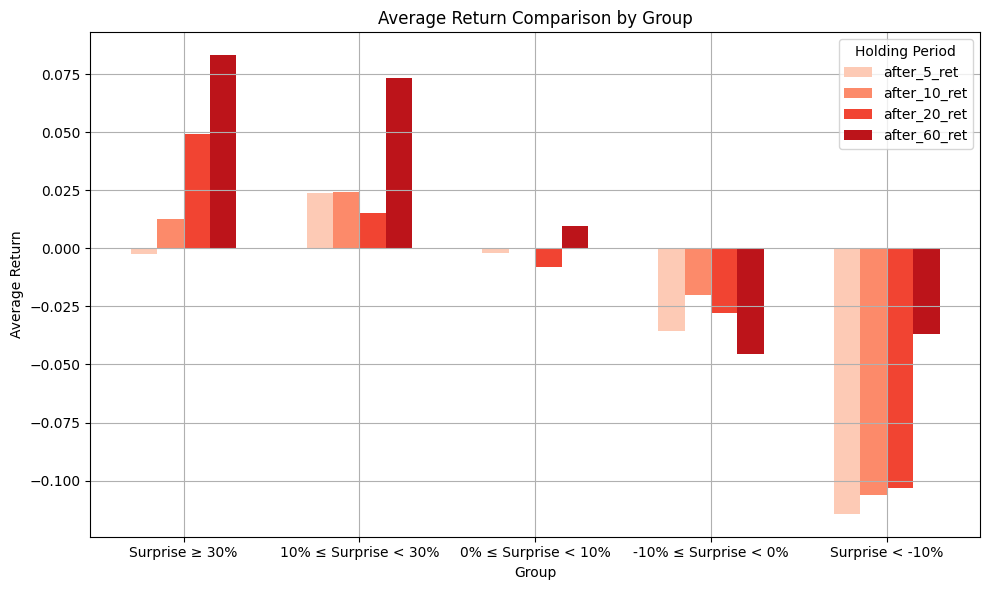

The bar chart below further breaks down the average returns across surprise categories and holding periods:

Clearly, the bigger the earnings beat, the higher the average return over time.

Conversely, earnings disappointments sharply dragged down performance.

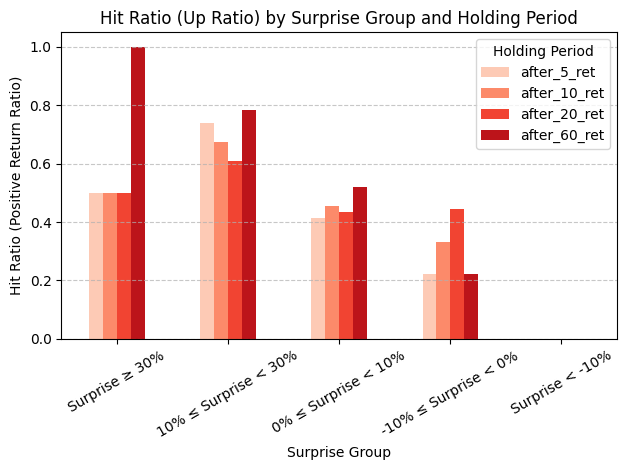

Probability of a Positive Return (Hit Ratio)

How often does Microsoft's stock actually rise after an earnings report?

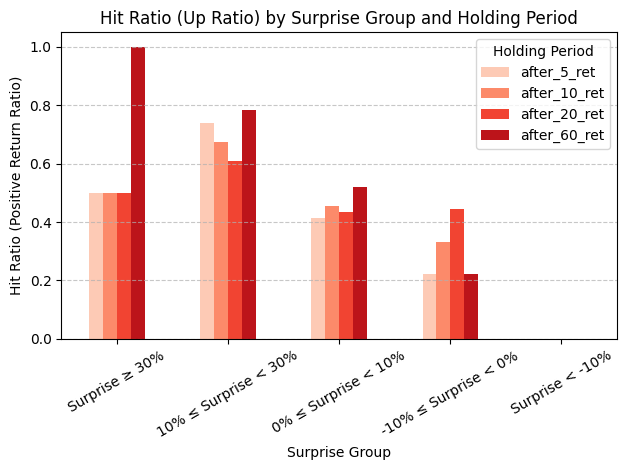

The chart below displays the hit ratio — the percentage of times the stock posted positive returns — grouped by surprise magnitude:

The results are striking:

With >30% surprises, the 60-day holding period saw a 100% win rate.

Even 10–30% surprises maintained a 70–80% positive return probability.

Meanwhile, mild beats or misses hovered around a 20–50% win rate.

A major earnings miss (<-10%) almost never resulted in positive returns.

Conclusion

The phrase "earnings move markets" isn't just a saying — it’s backed by data.

Tracking how far earnings deviate from expectations gives investors a crucial advantage.

For Microsoft, the bigger the earnings surprise and the longer you hold the stock afterward, the better your chances — and the bigger your gains.

Heading into Microsoft's April 30 earnings announcement, investors should focus less on the EPS number itself and more on how it stacks up against consensus estimates.

[Compliance Note]

All posts by Sellsmart are for informational purposes only. Final investment decisions should be made with careful judgment and at the investor’s own risk.

The content of this post may be inaccurate, and any profits or losses resulting from trades are solely the responsibility of the investor.

Core16 may hold positions in the stocks mentioned in this post and may buy or sell them at any time.