Amid persistent market volatility and high interest rates, investors are flocking to covered call ETFs as an income-generating alternative. Some of these ETFs have reported distribution yields of up to 15% over the past year, drawing considerable interest. But behind these attractive numbers lie tax implications and structural risks that investors should not ignore.

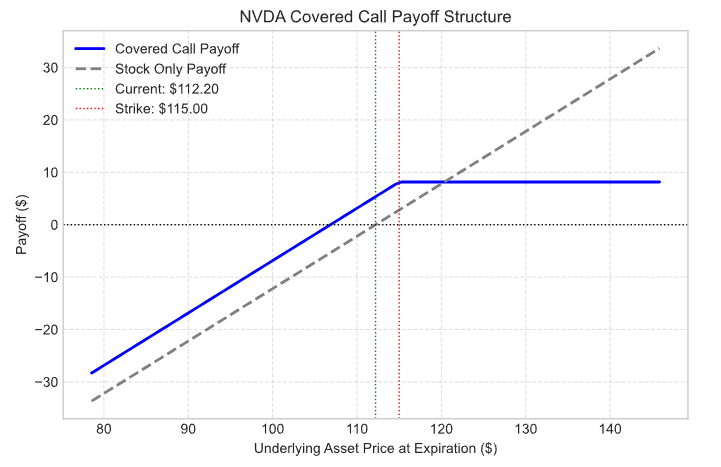

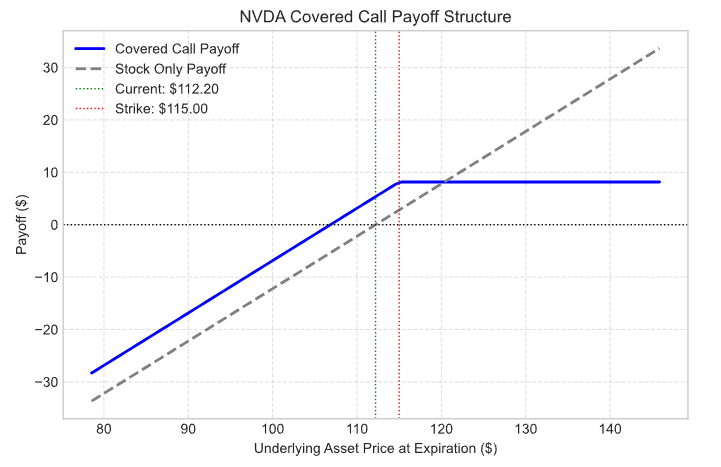

At its core, a covered call strategy is simple: the fund buys underlying assets (e.g., stocks or indices) and sells call options to collect premiums. For example, if an investor buys a stock at $100 and sells a one-month $150 call, they receive an upfront premium. If the stock does not rise significantly, the option expires worthless, and the premium becomes profit. However, if the stock soars above the strike, upside gains are capped, limiting total return potential.

Example: Covered Call Payoff Structure – NVIDIA

Structural Limitations and Tax Surprises

Recently, Korean asset managers have launched a wave of covered call ETFs, aggressively marketing them as tax-free yield solutions. However, many investors were caught off guard when distributions turned out to be taxable as dividend income, not the tax-exempt option premiums they expected.

The issue stems from how Korean equity dividends are distributed. Since domestic dividends are mostly concentrated in March, the majority of ETF payouts during this period consist of taxable income, while non-taxable option premium income plays a smaller role. As a result, some investors faced unexpected tax bills, despite being promised “tax-advantaged” products.

Investment Implications

It’s important to understand that covered call ETFs sell upside potential in exchange for monthly income. The dividends received are not “free money” but compensation for giving up future gains.

Investors should carefully review the fund’s distribution breakdown, tax treatment, and underlying strategy, rather than relying solely on headline yields or marketing claims. While covered call strategies can be effective in range-bound or volatile markets, they are not magic bullets for long-term growth.

[Compliance Note]

All posts by Sellsmart are for informational purposes only. Final investment decisions should be made with careful judgment and at the investor’s own risk.

The content of this post may be inaccurate, and any profits or losses resulting from trades are solely the responsibility of the investor.

Core16 may hold positions in the stocks mentioned in this post and may buy or sell them at any time.