Trump Breaks the Stats — What Happens After a Surprise Market Rally?

created At: 4/10/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

64

2

0

Fact

On Apr 9, the S&P 500 gained 9.52%, the third-highest daily return since WWII

-By comparison: +11.58% (Oct 13, 2008), +10.79% (Oct 28, 2008)

Nasdaq Composite rose 12.61%, the second-highest on record

-Highest: +14.17% (Jan 3, 2001)

Opinion

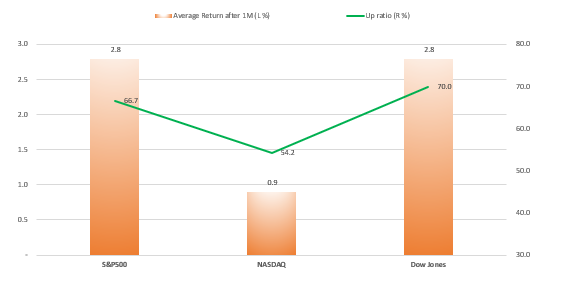

Historically, when the S&P 500 gains 6%+ in a single day, markets have tended to continue higher in the short term, with a 2.8% average return over the next month and a 67% chance of additional gains.

In contrast, the Nasdaq’s post-rally performance has been more muted, reflecting higher volatility and lower follow-through.

Core Sell Point

While one-day rallies exceeding 6% often signal short-term momentum, investors should note the variation in outcomes across indices:

The S&P 500 and Dow Jones tend to sustain gains, while the Nasdaq shows more volatility and weaker average returns.

64

2

0

Comments

0

Please leave a comment first