Tesla (TSLA) is scheduled to announce its Q1 2025 earnings on Tuesday, April 22.

After a steep 40% decline year-to-date, investors are questioning whether a disappointing earnings report could trigger further downside. However, history suggests the stock reacts more strongly to the company’s future outlook than to headline financial results.

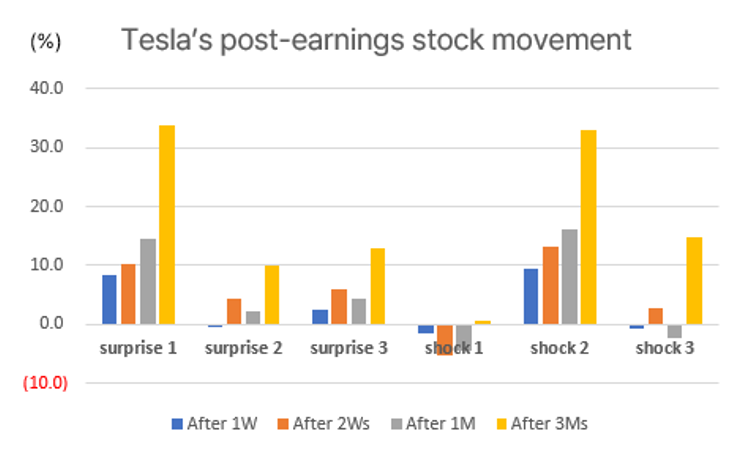

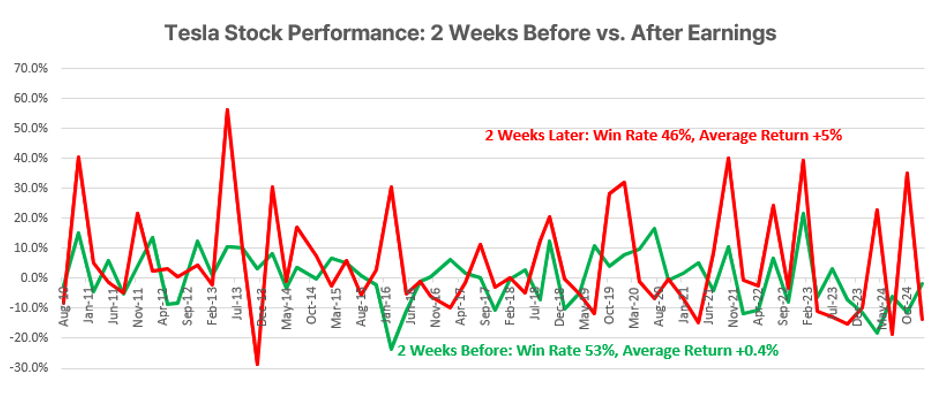

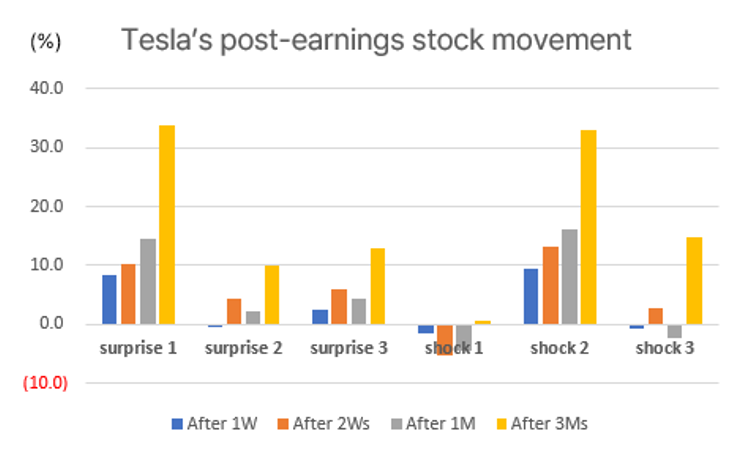

1. Stock Behavior After Earnings Surprises and Shocks

Historically, Tesla’s stock tends to rise after earnings announcements — both following positive surprises and negative shocks.

Interestingly, the worst stock performance has been observed after "mild disappointments" (shock 1; results falling between 0% and -30% below consensus).

Paradoxically, larger earnings misses (shock 2 and 3) often saw better stock performance than moderate ones.

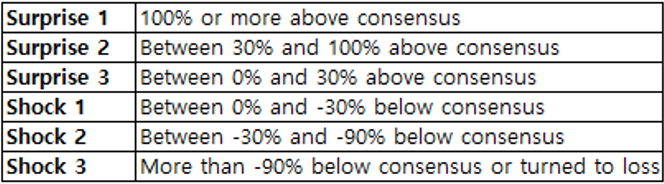

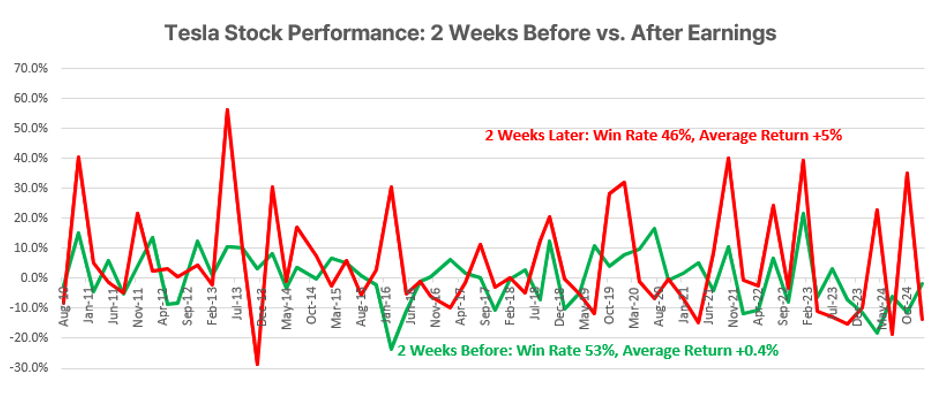

Even when examining the two-week periods before and after earnings, Tesla’s average return two weeks post-earnings exceeds +5%, despite a slightly below-50% chance of gains immediately after results.

Since Tesla's inclusion in the S&P 500 in Q2 2010, the probability that post-earnings returns outperform pre-earnings returns has stood at 55% across 60 quarters.

2. More Important Than the Numbers: The Future Vision

Tesla’s stock reacts more to future growth prospects discussed during earnings calls than to the actual earnings numbers.

Case 1: January 2025 Earnings Release

For Q4 2024 earnings (reported January 2025):

Despite these misses, Tesla’s stock rose 4.15% in after-hours trading and gained 2.87% the next day.

The rally was fueled by Elon Musk’s visionary statements during the earnings call, including:

Commercial rollout of Full Self-Driving (FSD) starting June 2025 in Austin, Texas

Plans for launching robotaxi services

Updates on the commercialization of the Optimus humanoid robot

Case 2: April 2024 Earnings Release

Similarly, during the Q1 2024 earnings release:

Despite a 9% decline in vehicle deliveries and lower year-over-year revenue,

Tesla’s stock jumped nearly 20% after the earnings call.

This was once again driven by strong future technology investment and product roadmap acceleration, not the quarterly financials.

3. Investor Behavior Patterns Around Tesla Earnings

Focus on Long-Term Growth: Investors prioritize Tesla’s future potential over short-term earnings misses.

Preference for Disruptive Innovation: High expectations around autonomous driving, AI, and robotics continue to support bullish sentiment.

High Volatility: The stock typically sees ±10% swings around earnings.

Better Post-Earnings Returns: Historically, returns over the two weeks following earnings are higher than in the two weeks before.

Conclusion

While Tesla’s earnings numbers certainly matter, the stock’s post-earnings trajectory is far more sensitive to management’s future vision.

Past patterns suggest that even disappointing financial results can be overlooked if Elon Musk paints a compelling technological future.

Tesla’s stock behavior reinforces its identity as a technology-driven company, rather than a traditional automaker.

Investors are betting not on today’s margins, but on tomorrow’s breakthroughs — in AI, full autonomy, robotaxis, and beyond.

Thus, investors should pay close attention not only to Tesla’s earnings figures but especially to management’s forward-looking commentary and technological roadmap.

[Compliance Note]

All posts by Sellsmart are for informational purposes only. Final investment decisions should be made with careful judgment and at the investor’s own risk.

The content of this post may be inaccurate, and any profits or losses resulting from trades are solely the responsibility of the investor.

Core16 may hold positions in the stocks mentioned in this post and may buy or sell them at any time.