2025 Gold Rush: Flight to Safety Accelerates

created At: 4/16/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

18

1

0

Fact

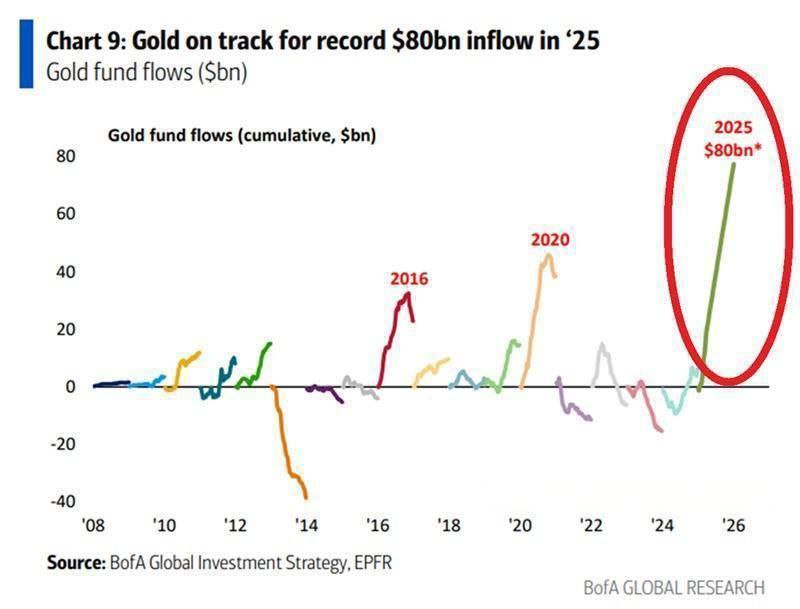

2025 YTD inflows into gold funds: $80 billion

Nearly 2x the full-year total in 2020

YTD gold price increase: +22%

52 all-time highs set over the past year

Strongest gold rally in 12 years

Opinion

Amid rising macro and geopolitical uncertainty, investors are shifting away from risk assets and seeking long-term safety in gold. As a hedge against inflation, currency volatility, and recession risk, gold is increasingly viewed as a structural portfolio stabilizer, not just a temporary refuge.

Core Sell Point

With gold absorbing more capital, the relative attractiveness of traditional risk assets may continue to diminish, especially if market volatility persists.

18

1

0

Comments

0

Please leave a comment first