Over the past week, the U.S. Dollar Index (DXY) has fallen by 3.5%, bringing its year-to-date decline to 8.4%. As capital continues to retreat from U.S. equities and Treasuries, investors are now increasingly shifting away from the dollar as well. Some analysts note that options traders are placing their biggest bets against the dollar in five years, signaling growing conviction in a sustained downtrend.

Historically, a weaker dollar has favored assets like gold, silver, copper, Bitcoin, and emerging market (EM) currencies and equities. A declining dollar increases the relative value of dollar-denominated assets and tends to push global capital toward higher-yielding or growth-sensitive regions.

This dynamic is well illustrated by the concept of the "Dollar Smile Curve"—which shows that the dollar typically strengthens in two extreme scenarios:

Strong U.S. economic growth or Fed tightening

Global economic crises, where the dollar serves as a safe haven

In contrast, the dollar tends to weaken during low-growth but stable global conditions, especially when U.S. growth underperforms relative to other regions.

Dollar Strength

→ Strong U.S. economy / Rising interest rates

→ Global risk-off sentiment and flight to safety

Dollar Weakness

→ Global economy steady but

→ U.S. growth relatively weaker

→ Capital flows outward from the U.S.

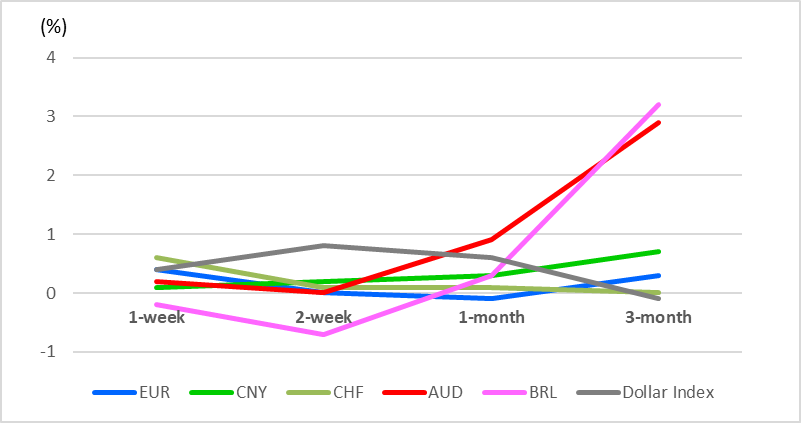

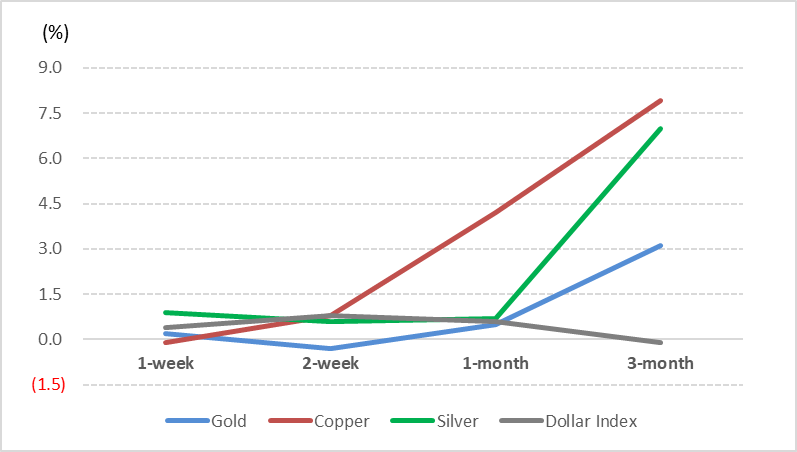

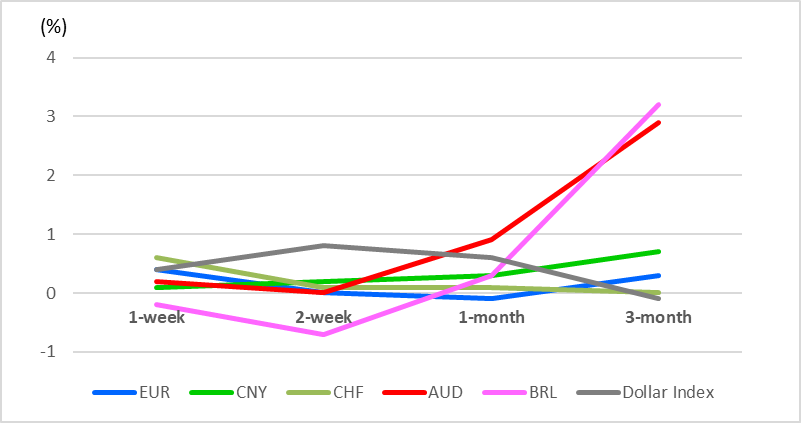

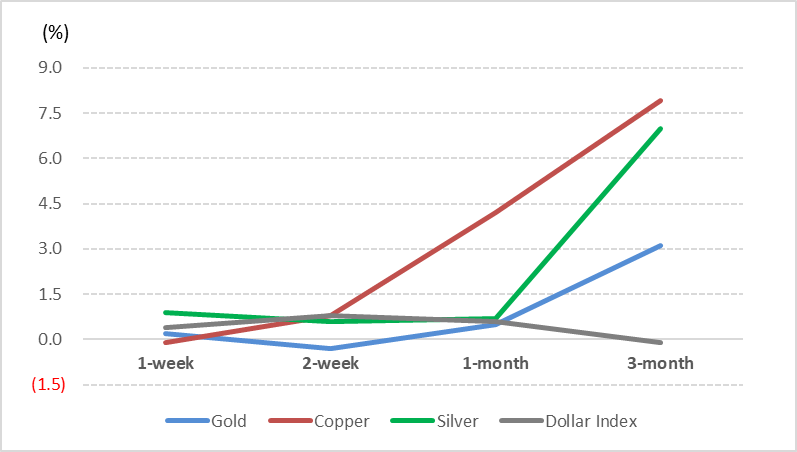

We analyzed historical “Dollar Weakness Events”—defined as days when the daily return of the Dollar Index falls below -3 standard deviations of its 30-day Bollinger Band—and tracked asset performance thereafter. The data shows that following such events, commodity-linked currencies like the Australian Dollar (AUD) and Brazilian Real (BRL) have tended to strengthen. Prices for gold, silver, and copper also rose, reflecting both inflationary expectations and solid global demand.

<Performance of Major Currencies Following Dollar Weakness>

<Price Movements of Key Commodities After Dollar Downturn>

In short, when dollar weakness coincides with a mild global recovery, as we've seen in previous cycles, it's often a setup for rallies in commodities, EM currencies, and risk assets like Bitcoin. However, according to the Dollar Smile framework, this only holds true as long as a global recession is avoided. If the macro environment shifts into contraction, the dollar could quickly reverse and regain its safe-haven appeal.

[Compliance Note]

All posts by Sellsmart are for informational purposes only. Final investment decisions should be made with careful judgment and at the investor’s own risk.

The content of this post may be inaccurate, and any profits or losses resulting from trades are solely the responsibility of the investor.

Core16 may hold positions in the stocks mentioned in this post and may buy or sell them at any time.