Earnings Season Begins: What’s the Upside Potential for JPMorgan?

created At: 4/11/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

15

1

0

Fact

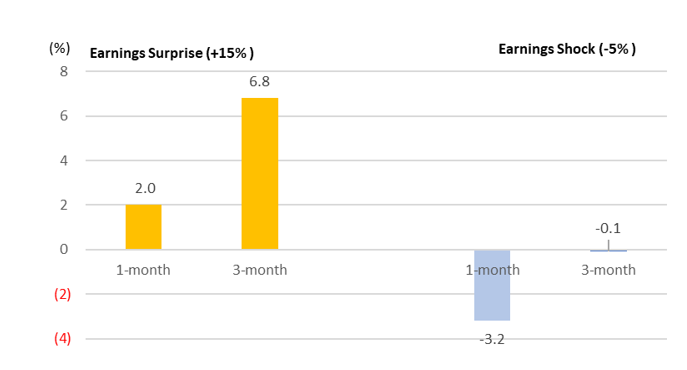

EPS beat >15%

→ +2.0% average return (1M), 67% chance of gain

→ +6.8% average return (3M), 63% chance of gain

EPS miss >5%

→ –3.2% average return (1M), 58% chance of decline

Opinion

JPMorgan earnings surprises historically result in a slow but steady positive trajectory over the medium term, while negative surprises tend to trigger sharp, short-term downside moves. The reaction pattern emphasizes sentiment momentum more than intraday volatility.

Core Sell Point

A strong beat may support a gradual rally over the following 3 months, while a significant miss could lead to further downside in the near term, outweighing short-lived rebound attempts.

15

1

0

Comments

0

Please leave a comment first