Retaliation or Recalibration? Global Markets React to Trump’s Tariff Push

created At: 4/8/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

22

0

0

Fact

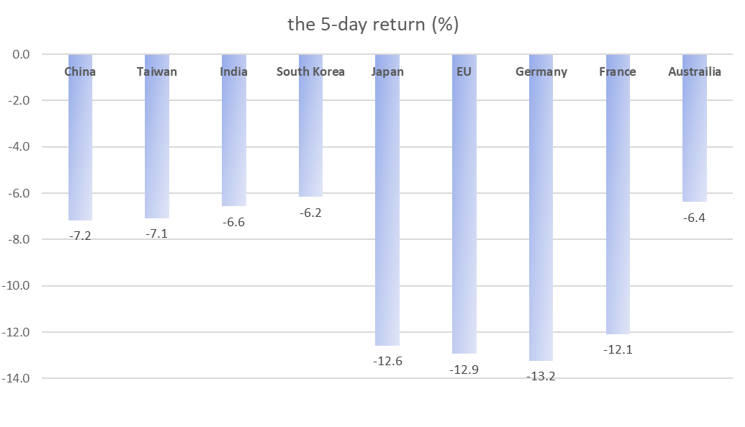

Global equity markets fell sharply over the past five days

-China: -7%

-South Korea: -6%

-EU: -13%

-Japan: -13%

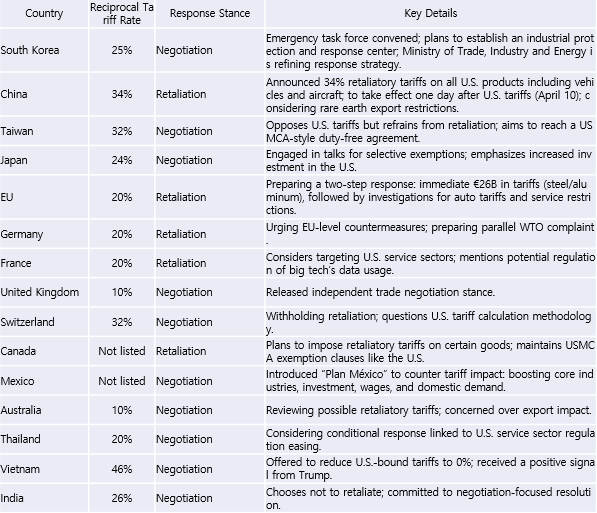

China and EU announced retaliatory responses

EU’s tariff timeline includes a delay and review phase, hinting at room for negotiation

Opinion

Despite initial retaliatory rhetoric, most countries have incentives to avoid an all-out trade war. Policy focus is shifting toward strengthening domestic demand, including tax reform in the U.S. and stimulus efforts abroad.

Core Sell Point

Market responses reflect more than just tariff levels—they reveal how well-equipped countries are to pivot toward domestic growth. The trajectory ahead will hinge on policy flexibility and whether diplomacy prevails over escalation.

22

0

0

Comments

0

Please leave a comment first