5 Key Points for Determining the Right Time to Sell Stocks! (Jun 18, 2020)

created At: 3/11/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

57

0

0

Fact

In bear markets, there is always a reason to sell.

Long-term investors’ sell decisions are primarily based on reaching fair value, seizing better opportunities, and changes in investment themes.

Emotional biases and cognitive errors can hinder rational sell decisions.

To overcome emotional bias when reaching fair value, strategies such as quantifying qualitative judgments, the blank slate test, maintaining terminal inputs, regularly reviewing business characteristics, partial selling, and setting a fair value range are recommended.

To address changes in investment themes, documenting preliminary sell reasons, detecting warning signals, and applying Philip Fisher’s three-year rule can be useful.

Although regret is inevitable after selling, learning from past decisions can improve future decision-making.

Selling is a tool for portfolio and risk management, and it is important to base your decisions on clear, objective criteria.

Opinion

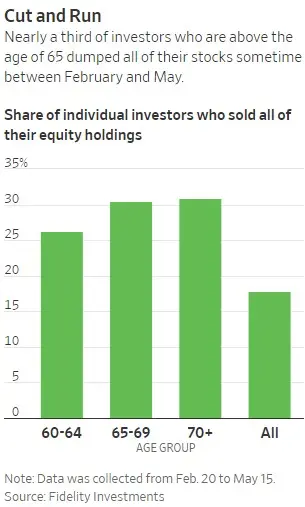

Investors are prone to making emotional sell decisions during extreme market downturns. Older investors, in particular, may sell more due to concerns about not being able to endure long recovery periods. Therefore, to improve long-term investment performance, it is effective to establish and adhere to a rules-based rebalancing strategy that reflects your financial goals, risk tolerance, and specific guidelines rather than relying on emotional reactions.

Core Sell Point

For successful investing, it is crucial to set clear asset allocation principles based on your personal investment environment and risk tolerance, and to follow these principles strictly to avoid being swayed by market volatility and emotions.

57

0

0

Comments

0

Please leave a comment first