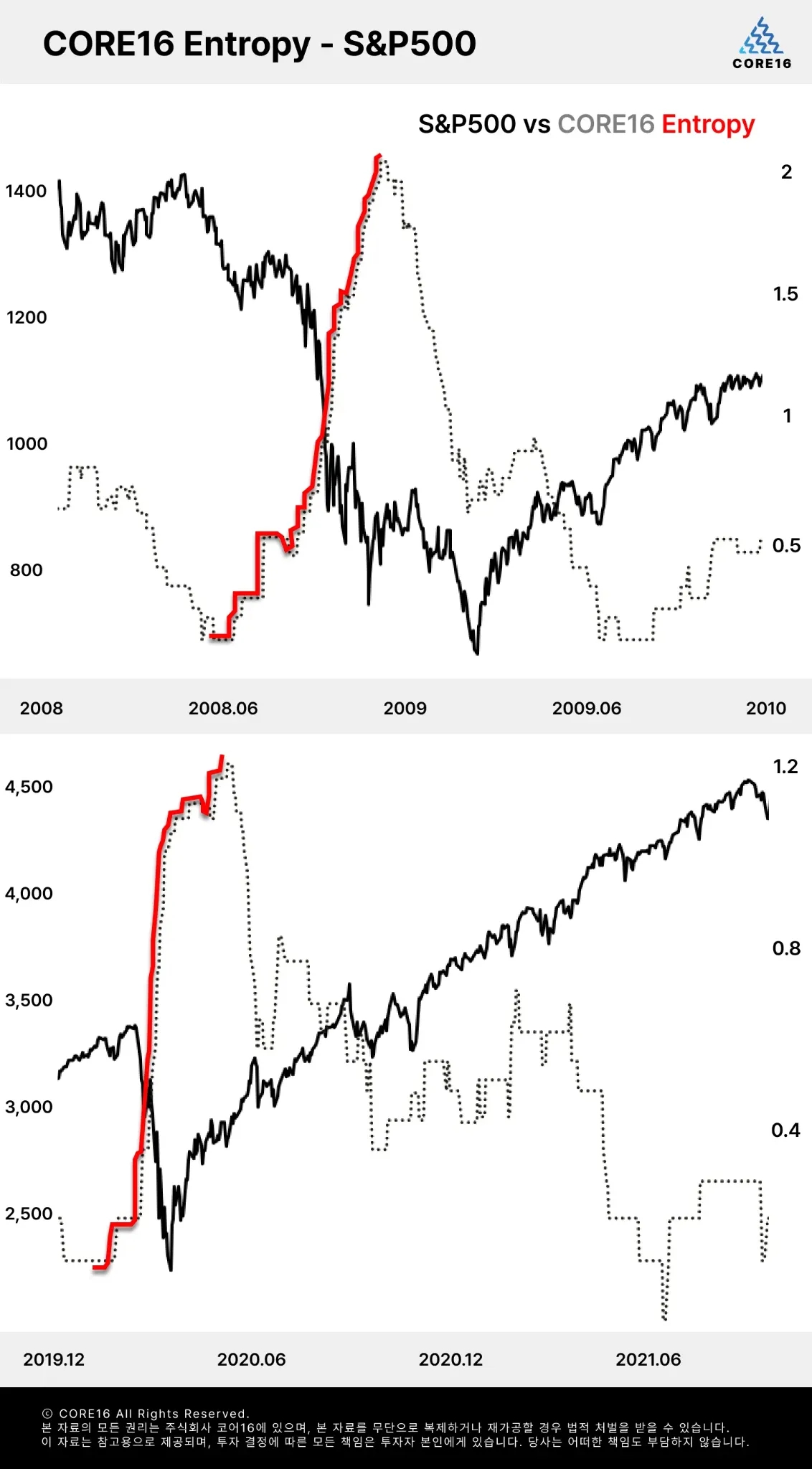

Did the CORE16 Entropy Indicator Capture S&P 500 Volatility?

created At: 3/4/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

94

0

0

Fact

The CORE16 Entropy Indicator measures market information dispersion, serving as a risk signal that can be analyzed alongside the S&P 500.

During both the 2008 financial crisis and the 2020 COVID-19 crash, sharp spikes in the entropy indicator coincided with significant market declines, highlighting its potential as an early warning tool for increased market risk.

Opinion

The Entropy Indicator helps identify risk phases in advance, but it should be analyzed alongside macroeconomic indicators, corporate earnings, and other fundamental factors for a comprehensive assessment.

During periods of extreme market fluctuations, the indicator can serve as a supporting tool to evaluate optimal portfolio adjustment timing.

Core Sell Point

Utilize the CORE16 Entropy Indicator to quickly detect hidden market risks and stay prepared with a well-planned strategy, even in periods of uncertainty.

94

0

0

Comments

0

Please leave a comment first