Investment Strategy Based on September Stock Patterns: VTRS & AMT

created At: 3/4/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

45

0

0

Fact

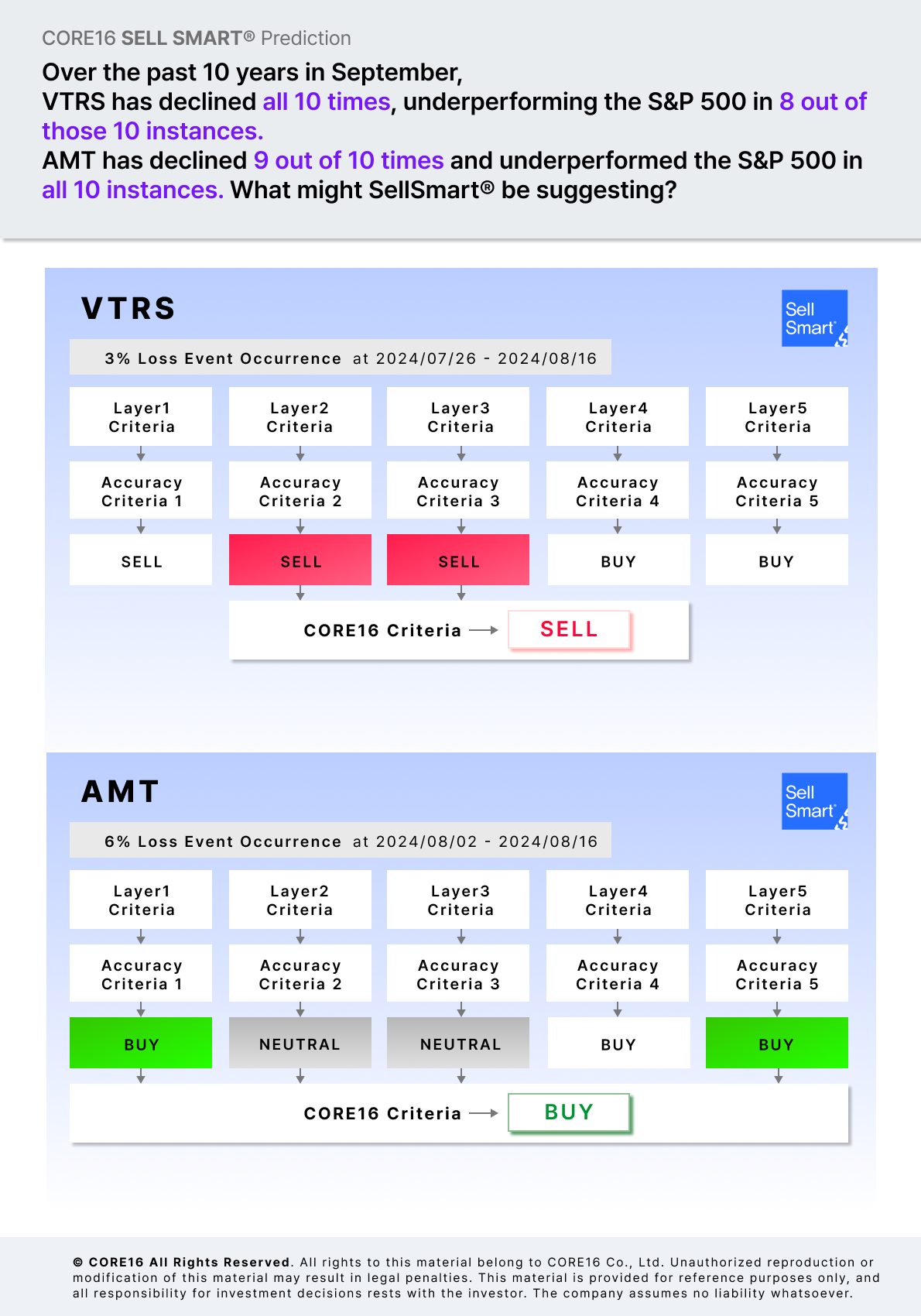

Over the past 10 years, VTRS (Viatris) has declined in all 10 September periods, underperforming the S&P 500 in 8 of those years. Meanwhile, AMT (American Tower) has declined in 9 out of the last 10 Septembers and underperformed the S&P 500 in all 10 years.

The CORE16 SellSmart® algorithm has issued a Sell recommendation for VTRS and a Buy recommendation for AMT.

In the 3% Loss Event analysis for VTRS, there were 3 sell signals and 2 buy signals, leading to a final Sell recommendation.

For AMT, the 6% Loss Event analysis identified 2 buy signals, 2 neutral signals, and 1 additional buy signal, resulting in a final Buy recommendation.

Opinion

The SellSmart® recommendations are based on historical performance and pattern analysis, providing a statistically backed investment judgment.

For VTRS, the negative September pattern has consistently repeated, suggesting a conservative approach. A sell strategy appears reasonable given its persistent underperformance.

In contrast, while AMT may experience short-term declines, SellSmart® analysis indicates long-term recovery potential, making it a viable buy opportunity.

However, since this analysis is based solely on historical data, it is essential to also consider current market conditions and additional factors before making investment decisions.

Core Sell Point

VTRS's consistent September decline pattern makes a sell strategy appropriate, while AMT's long-term recovery potential supports a buy recommendation.

45

0

0

Comments

0

Please leave a comment first