Red Light for Risk Appetite(Feb 25, 2025)

created At: 2/26/2025

Neutral

This analysis was written from a neutral perspective. We advise you to always make careful and well-informed investment decisions.

104

0

0

Fact

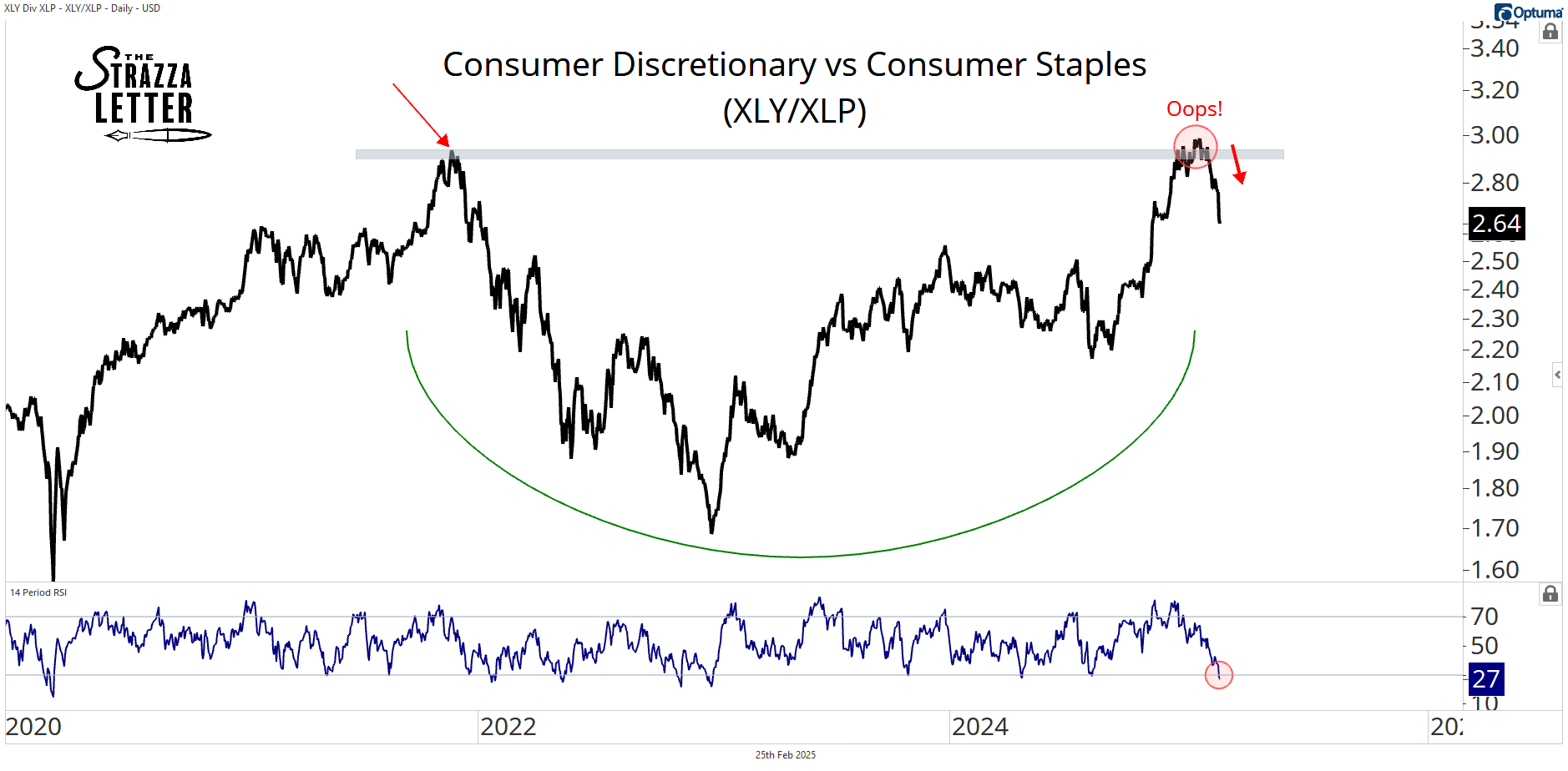

XLY(Consumer Discretionary)/XLP(Consumer Staples) ratio key for measuring risk appetite

Current XLY/XLP indicators show:

Failed breakout with multi-month lows

Post-election gains erased

Lowest momentum since 2022 bear market

Violation of VWAP from August low

Opinion

The analysis overvalues a single technical indicator while ignoring fundamental economic factors. The XLY/XLP ratio, while useful, cannot alone predict market direction. Characterizing normal market fluctuations as "bear market behavior" reflects alarmist thinking that potentially drives emotional rather than rational decision-making.

Core Sell Point

Predicting a bear market based solely on the XLY/XLP ratio oversimplifies complex market dynamics and risks fueling fear-based investment decisions rather than comprehensive analysis of economic conditions.

104

0

0

Comments

0

Please leave a comment first